1. ROI (Return on Investment)

Definition: ROI measures the profitability of an investment relative to its cost. It’s a straightforward way to gauge how much profit you’re making from your real estate investment compared to what you spent.

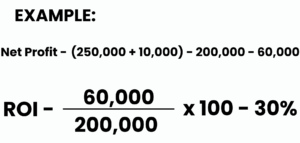

Example: You bought a rental property for $200,000 and sold it later for $250,000. During your ownership, you earned $10,000 in rental income. Your total net profit is the selling price plus rental income minus the purchase price.

So, your ROI is 30%, meaning you earned 30% of your original investment amount as profit.

2. AAR (Average Annualized Return)

Definition: AAR shows the average annual growth rate of your investment, factoring in the effects of compounding over time. It’s a useful metric for understanding the annual performance of your investment.

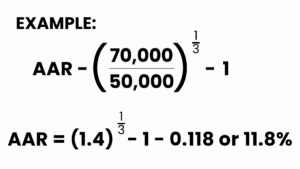

Example: You invested $50,000 in a property, and after 3 years, it’s worth $70,000. To find the AAR:

So, the average annualized return is approximately 11.8%, meaning your investment grew by about 11.8% per year, on average.

3. IRR (Internal Rate of Return)

Definition: IRR is the discount rate that makes the net present value (NPV) of all cash flows from the investment equal to zero. It helps you understand the annualized effective rate of return on your investment.

Example: You invested $100,000 in a property, and over 5 years, you received cash flows of $20,000, $25,000, $30,000, $35,000, and $40,000. If you use an IRR calculator or financial software, you’ll find that the IRR is approximately 12%. This means your investment’s annual return, considering the timing and size of cash flows, is around 12%.

4. Cash on Cash Return

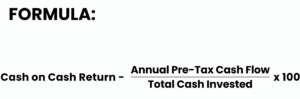

Definition: Cash on Cash Return measures the annual return on the actual cash you invested, as opposed to the total property value. It’s particularly useful for evaluating rental properties.

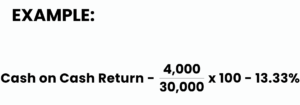

Example: You bought a rental property with an initial cash investment of $30,000. You earn $4,000 annually in rental income.

So, your Cash on Cash Return is 13.33%, indicating you earn 13.33% of your invested cash back in rental income each year.

Conclusion

Understanding these key metrics—ROI, AAR, IRR, and Cash on Cash Return—is essential for making informed real estate investment decisions. Each metric provides a different perspective on the profitability and performance of your investments. At Willow Investment Group, we’re here to help you navigate these concepts and apply them to your investment strategy. With a clear grasp of these metrics, you can confidently assess opportunities, maximize your returns, and achieve your financial goals.